Quarterly Letters & Insights

CAZ Investments Quarterly Letter 2024 – Quarter 4

A New World in Some Ways, Same World in Others

There have been some seismic shifts in the world since we released our last letter. The election in November shifted the political landscape here in the United States, but its effect has quickly been felt around the world. As we mentioned in October, a split government in the U.S. can be fairly easy to predict because it usually leads to gridlock. But a government where one party controls the Presidency, and both houses of congress can be highly unpredictable. That is certainly where we find ourselves today and so we are going to focus our attention on what we can predict with a high level of certainty.

To provide as much guidance as to how we see the investing landscape today and therefore how we are allocating our personal capital, we will lean heavily on the incredibly successful CAZ Themes for 2025 event that was held in Houston on January 16th. For those who did not participate in person, alongside more than 600 people from all over the world, we hope that you will make it a priority to make the trip to Houston next January. Please click HERE to watch a very brief highlight reel from our event this year.

One of the amazing things about our world today is how we can use artificial intelligence to summarize large amounts of material into bite sized chunks. With credit to OpenAI, (in whom we were very early investors) known to most people as ChatGPT, we have generated bullet point summaries of most of the slides from our event. So, to make this as efficient for you as possible, we have provided the bullet points for each section below and then the images of the slides themselves afterwards.

We hope that you will find all the information useful, and that a picture will indeed say a thousand words. Please let us know if you have any questions about anything presented and would like to discuss how you can partner alongside us in the vehicles we have built to profit from each of the themes presented.

What will become clear to you from the information below is that there are very unique opportunities available, but there are also many risks to be concerned about, with the glaringly obvious one being valuations in traditional assets. The data should explain why we remain a “1” on the CAZ Scale. We firmly believe that the risk/reward profile of traditional risk assets is not very favorable. It is for this reason that we believe that every single investor must, not should, have a risk mitigation plan in place for their portfolio. We have created innovative solutions to help investors hedge their portfolio against the “what if,” and if you are not familiar with what we are doing in that area please speak to our Team to learn more.

We continue to see imminently more attractive opportunities for consistent and predictable returns in the private markets, while also benefitting from the lower correlation of those assets compared to traditional investments.

It is hard to believe that it is 2025 and we hope that everyone makes it an amazing year! With that, here are the bullet summaries for the slides to follow. All our very best!

The CAZ Investments Team

Macroeconomic Update

- Rate Cuts Started but Have Been Minor:

- Fastest tightening cycle in four decades.

- Rates decreased by 1% in 2024 but increased by 5.25% previously.

- Market Perception of Rate Cuts:

- The market appears to believe the Fed may have cut rates too soon, with long-term rates rising by 1%, offsetting much of the impact from the lowering of short-term rates.

- Inflation remains sticky and continues to drive up costs across the economy.

- Fiscal Challenges:

- U.S. national debt has reached $36 trillion, the highest in history.

- Debt-to-GDP ratio is at its highest since World War II.

- Annual debt servicing costs are now $1.1 trillion, impacting fiscal flexibility.

- Rising interest rates exacerbate the burden of servicing national debt.

- Political Power Shift:

- Unified Republican control in the House, Senate, and Presidency may drive policy changes.

- Key Risk Factors:

- Geopolitical uncertainties, including conflicts and trade tensions.

- Ongoing supply chain disruptions.

- Emerging cybersecurity and artificial intelligence risks.

- Higher long-term interest rates weighing on economic growth.

The Impact of Higher Rates

- Mortgage Rates Remain Stubbornly High:

- Rates exceed 7%, making housing increasingly unaffordable.

- Mortgage Bankers Association index data shows declining refinancing and purchase activity.

- Consumer Debt:

- Credit card interest rates are at a 30-year high, increasing financial strain on households.

- Delinquency rates now mirror those seen during the 2008 financial crisis.

- Corporate Bankruptcies:

- In 2024, there were the highest number of bankruptcy filings in the U.S. since the Global Financial Crisis.

- Signs of Optimism:

- Small business confidence index skyrocketed after the election, indicating the possibility of rising optimism and a willingness to invest.

A Look at Asset Classes – Fixed Income

- Negative Returns Over Five Years:

- U.S. bonds have provided negative total returns over the last five years.

- Credit Spreads and Risk Appetite:

- Credit spreads remain historically low, signaling complacency among investors.

- Investors may not be pricing risk appropriately given economic uncertainty.

- Diversification Challenges:

- Stock-bond correlations at a 40-year high, reducing their traditional diversification benefit.

- Bonds have not provided the benefits of downside protection they once did.

A Look at Asset Classes – Equity Markets

- Returns Driven by Valuation Expansion:

- More than 71% of the S&P 500 returns over the last two years have come from multiple expansion.

- Earnings growth has only contributed 14% to recent market gains.

- Concentration Risk:

- The largest 10 stocks represent 38% of the S&P 500’s total weight but contributed 64% of gains.

- The “Magnificent Seven” accounted for 57% of all returns in 2023-2024.

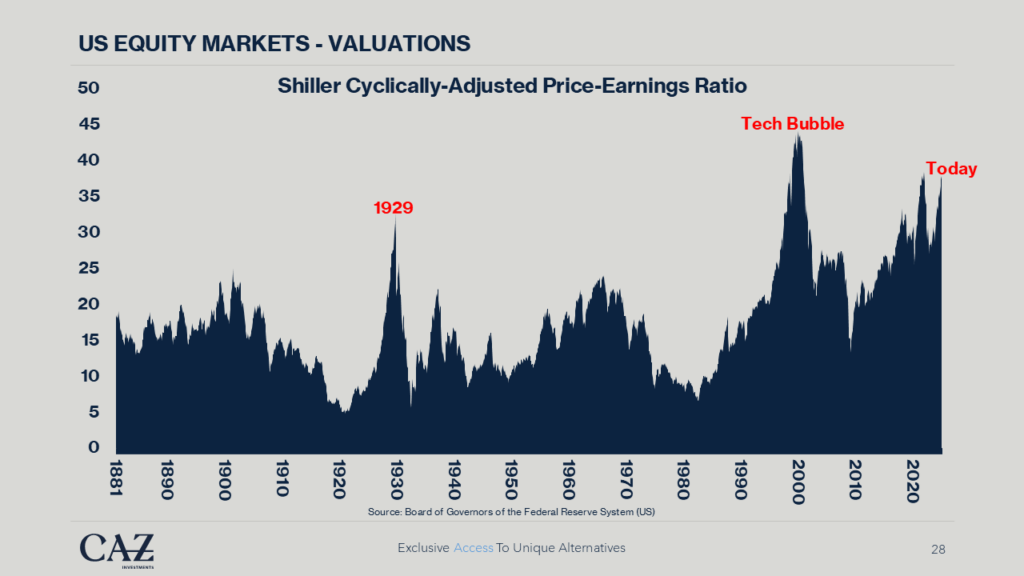

- Overvaluation Risks:

- The cyclically adjusted price-to-earnings ratio (CAPE) is at its highest level ever, other than the tech bubble of the late 90’s, even higher than before the Great Depression in 1929.

- The Buffett Indicator shows valuations significantly higher than even late 90’s tech bubble, and historical regression relationships would indicate the potential for -11% annualized returns over the next decade.

- The S&P 500 is overvalued, utilizing virtually every possible measurement, compared to historical levels.

- Every sector of the S&P 500 is expensive, OTHER than Energy.

- The Equity Risk Premium has turned negative, for the first time in more than 20+ years. This means stock market investors are receiving no expected incremental return compared to a 10-year U.S. Treasury.

A Look at Asset Classes – Real Estate

- Significant Debt Maturities:

- More than $1 trillion in multifamily debt is set to mature in the next five years.

- Office Sector Struggles:

- Office delinquency rates now exceed financial crisis levels.

- The sector faces accelerating distress.

Where We Are Investing Our Personal Capital

- Diversification Focus:

- The path to the “Holy Grail of Investing” has been demonstrated to consist of a portfolio design that includes 8-15 less correlated investments.

- Investments in energy, GP stakes, private credit, and sports have historically provided very good returns, with little correlation to each other or to other asset classes.

- Energy Investments:

- Energy demand is expected to grow significantly, requiring increased supply.

- Public energy companies trade at a 65% discount to non-energy sectors.

- Private upstream assets are undervalued by 44% compared to public counterparts.

- GP Stakes:

- Owning top-tier fund managers can provide very attractive positively asymmetric returns.

- Secondary market for GP stakes has grown 10x in the last decade and CAZ is the dominant player.

- The lack of harvest across the world of private equity over the last 3 years bears a strong resemblance to the levels experienced in the Global Financial Crisis. If that relationship was maintained, the next few years could generate a significant increase in distribution levels. That could benefit the owners of the firms that are managing the capital, in the form of significantly increased revenue from Carried Interest.

The Void Left Behind by Regional Banks

- Find a Need, Fill a Need, Get Paid

- With regional banks exiting the market, new opportunities in private lending have emerged.

- Limited Partners of private equity funds have experienced $1.2T of net outflows in the last 7 years and face limited liquidity options, such as selling assets at a discount or seeking expensive loans.

- CAZ has positioned itself to be a significant buyer of assets in the secondary market, frequently at very attractive discounts, and as the market leading lender to the owners of alternative investments.

The Changing Consumer

- Cord Cutting Trends:

- The decline in traditional pay TV has made live sports content more valuable.

- Sports accounted for 97 of the top 100 most-watched live programs in 2023, up from 14 in 2005.

- NFL content alone represents 94 of the top 100 programs.

- Private equity recently received limited approvals from the league to own NFL franchises, for the first time ever, and CAZ is fortunate to be able to provide that opportunity to its network.

- Significant Debt Maturities:

- More than $1 trillion in multifamily debt is set to mature in the next five years.